Market Perspectives – June 2017

Capital Markets

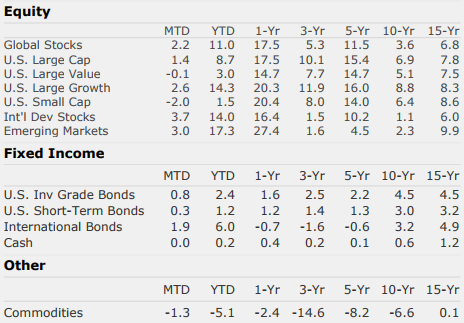

Global markets advanced in May as the bull market remained intact. Leadership trends that developed at the beginning of 2017 continued to persist with growth stocks leading value stocks, large companies leading small companies, and international and emerging markets companies leading domestically based companies.

Fixed income markets held steady as the much anticipated rising rate environment has not materialized. The 10-year U.S. Treasury bond has fallen from approximately 2.6% to around 2.2% since March 10th. Since that time, the Federal Reserve has raised interest rates and today the 1-month Treasury Bill yields 0.25% more than it did on March 10th. In other words, short term interest rates have risen and long-term interest rates have fallen.

The Fed has continued to signal two additional rate hikes this year, and we believe the next hike will happen at the June meeting in a couple of weeks. Expect September or December to also be candidates for rate future rate hikes. As the Fed continues to raise rates, we will keep an eye on longer-term interest rates. If long rates continue to fall it will impede the Fed’s ability to continue its plans for tightening. Historically, one of the best predictors of a recession has been when long-term interest rates fall below short-term rates causing the “yield curve” to “invert”.

While stocks and bonds have fared well so far in 2017 Commodities have broadly underperformed. They are down 5.1% on the year and were down 1.3% in May. Commodities continue to be the worst performing asset class over the 5-, 10-, and 15-year periods having posted terrible returns in recent years. Historically speaking, it is rare to see an asset class underperform for so long which gives us some comfort that fortunes may reverse in the medium-term.

The Eighth Wonder of the World

What is the most important thing to know if you are an investor? What is the secret sauce that led Warren Buffet to have so much success? If you ask investment professionals across the world the answer will vary. You will probably get a lot of comments about buying low and selling high, being fearful when others are greedy, or being greedy when others are fearful. But I’m going to let you in on a little secret. There is one force that is more powerful in investing and life than any other force. This force sits right in front of us but, as human beings, we have trouble seeing it and often engage in very basic activities that destroy the force altogether. That force is called: COMPOUNDING. Albert Einstein called it the 8th wonder of the world and I agree. Let me provide a few observations:

- Warren Buffett has effectively been doing the same job since he got out of Columbia Business School in the 1950s. He became a millionaire in 1962, in 1970 he bought Berkshire Hathaway and became a billionaire in 1990, twenty years later. He is worth more than $73 billion today according to Forbes. Unlike his fellow billionaires Jeff Bezos and Bill Gates, Warren didn’t create a new company that sailed to sky high valuations. Warren’s genius was that he was willing to get rich slowly and that meant owning companies that compound.

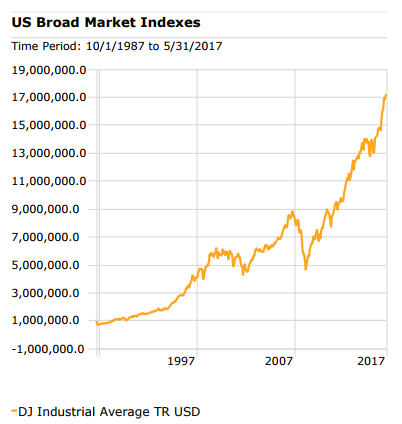

- The two keys to compounding are (1) invest as much money as you can and don’t stop investing and (2) have a very long time period. The power of compounding is felt after many years. For instance, $1M today invested at a 10% return will give you $100,000 of gains next year but after ten years you would have over $2.5M, after 30 years ~$17.5M, and after 55 years (the length of time Warren Buffet has owned Berkshire) you would have $189M.

- We are wired to focus on the short-term. I am constantly shown new ideas based on a three-year return stream or shown private equity deals where they buy companies and are forced to sell in seven years or less.

- I’m not suggesting that there aren’t good shorter term ideas, my point is that the best way to invest is to buy companies, hold cash and bonds to protect on the downside, and avoid making changes too frequently. It’s important to resist the urge to tinker.

The next time we go to buy a house, a car, or a boat we should think about how much money we are giving up in future dollars. Compounding may be the 8th wonder of the world, but all too often we are all blind to its power.

The information published herein is provided for informational purposes only, and does not constitute an offer, solicitation or recommendation to sell or an offer to buy securities, investment products or investment advisory services. All information, views, opinions and estimates are subject to change or correction without notice. Nothing contained herein constitutes financial, legal, tax, or other advice. The appropriateness of an investment or strategy will depend on an investor’s circumstances and objectives. These opinions may not fit to your financial status, risk and return preferences. Investment recommendations may change and readers are urged to check with their investment advisors before making any investment decisions. Information provided is based on public information, by sources believed to be reliable but we cannot attest to its accuracy. Estimates of future performance are based on assumptions that may not be realized. Past performance is not necessarily indicative of future returns. The following indexes were used as proxies in the performance tables: Global Stocks = MSCI ACWI; U.S. Large Cap = S&P 500; U.S. Large Value = Russell 1000 Value; U.S. Large Growth = Russell 1000 Growth; U.S. Small Cap = Russell 2000; Int’l Dev Stocks = MSCI EAFE; Emerging Markets = MSCI EM; U.S. Inv Grade Bonds = Barclays U.S. Aggregate; U.S. High Yield Bonds = Barclays Corporate High Yield; Emerging Markets Debt = JPMorgan EMBI Global Diversified; Int’l Bonds = Barclays Global Treasury ex US; Cash = 3month T-Bill; Sector returns displayed in the chart represent S&P 500 sectors, while treasury benchmarks are from Barclays

Quote of the Month

“Lethargy, bordering on sloth should remain the cornerstone of an investment style.”