Market Perspectives – August 2017

Capital Markets

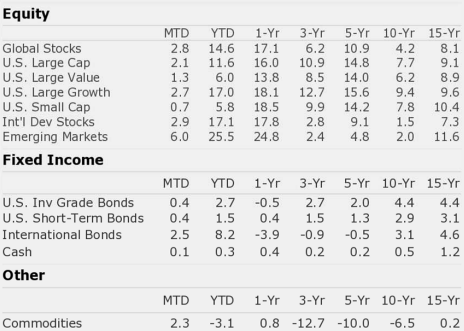

Stocks began the third quarter on a positive note. July’s market action was generally a continuation of the leadership trends of 2017. U.S. large cap stocks were the leaders within the U.S., while U.S. small cap value lagged within the U.S. equity market styles. Within large cap growth, the tech companies continued their dominance with Facebook, Microsoft, Priceline, Apple, Amazon, and Netflix leading the broad market.

International stock markets extended their positive momentum as the emerging markets led the way with Brazil, China, and India all posting strong returns. So far in 2017, international investments have been buoyed by the sharp decline in the U.S. Dollar, following three years of strengthening.

Fixed income posted modest gains. Inside the fixed income markets, higher risk sectors such as emerging market debt and high-yield bonds provided the best returns while higher quality sectors such as U.S. Treasuries lagged as longer term interest rates rose slightly and credit risk paid off.

In other sectors, commodities posted a solid return for the month after having a poor first half of 2017. The commodities rally was driven by oil which rebounded strongly in July.

The Federal Reserve left interest rates untouched in July, just as many expected. Recent Fed communications suggest that further gradual rate increases are likely and we expect a rate increase in both September and December, barring an unforeseen geopolitical event. Further, the Fed has begun to more definitively suggest that they will reduce the size of their balance sheet in the near future. In reducing the balance sheet, the Fed will effectively begin to unwind the post-financial crisis bond purchase programs that provided unprecedented monetary stimulus to the capital market system. Look for future Market Perspectives to dig deeper into the effects of Fed unwinding.

Volatility in the markets has been at its lowest levels in decades. It’s a bit cliché to suggest that volatility will increase soon. We don’t know when it will revert to more normal levels, but we do think these calm seas present a nice opportunity to rebalance portfolios, diversify abroad, and prepare for tougher times. The calm seas could remain for years or they could end abruptly.

The Question Everyone Wants Answered

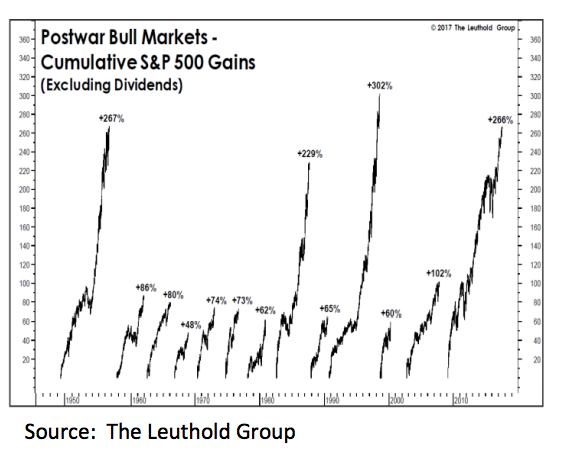

We have been receiving the same question from many of our clients recently. The question is effectively some iteration of: “After so many years of the stock market going up, when will we see a major bear market again?” Here is our best attempt at an answer:

- Famed investor Sir John Templeton often referred to the final stage of a bull market as “euphoric”. To us, investor sentiment is far more muted than the euphoric stages of past bull market tops.

- The very fact that so many people are asking when the market will crash gives us a certain amount of confidence that the bull market is not dead.

- Today’s environment of stable GDP growth, muted inflation, and benign wage growth is far different than previous bull market ends and is supportive of equity prices.

- While banks have begun to see a higher appetite for risk-taking they remain far better capitalized than in the financial crisis.

- Value investor Howard Marks is well known for his memos that have provided amazing insight into the markets. Marks pointed out last week in a lengthy letter that things are beginning to look excessive. He noted the markets’ extreme valuations, the rise in ETF trading, high willingness of investors to take on long-term risk for low levels of return, and investor appetite for non-traditional investments that carry unique risks.

- Mr. Marks is one of our favorite investment writers and we agree with many of his points. We agree that valuations are high and signs of excess have begun to appear, but we also don’t see the exuberant animal spirits that characterize most tops.

- By our estimation, this is a good time to reassess the durability of your portfolio to ensure you aren’t taking undue risk. Further, having some exposure to “dry powder” assets such as high-quality short-term bonds makes a lot of sense.

- Lastly, don’t be afraid to participate in the markets. More money has been lost waiting on the next crisis than in crises themselves. Missing out as the market runs can be a powerful force leading to undue risk-taking at the wrong time. Stay invested, but make sure your seatbelt is securely fastened.

The information published herein is provided for informational purposes only, and does not constitute an offer, solicitation or recommendation to sell or an offer to buy securities, investment products or investment advisory services. All information, views, opinions and estimates are subject to change or correction without notice. Nothing contained herein constitutes financial, legal, tax, or other advice. The appropriateness of an investment or strategy will depend on an investor’s circumstances and objectives. These opinions may not fit to your financial status, risk and return preferences. Investment recommendations may change and readers are urged to check with their investment advisors before making any investment decisions. Information provided is based on public information, by sources believed to be reliable but we cannot attest to its accuracy. Estimates of future performance are based on assumptions that may not be realized. Past performance is not necessarily indicative of future returns. The following indexes were used as proxies in the performance tables: Global Stocks = MSCI ACWI; U.S. Large Cap = S&P 500; U.S. Large Value = Russell 1000 Value; U.S. Large Growth = Russell 1000 Growth; U.S. Small Cap = Russell 2000; Int’l Dev Stocks = MSCI EAFE; Emerging Markets = MSCI EM; U.S. Inv Grade Bonds = Barclays U.S. Aggregate; U.S. High Yield Bonds = Barclays Corporate High Yield; Emerging Markets Debt = JPMorgan EMBI Global Diversified; Int’l Bonds = Barclays Global Treasury ex US; Cash = 3month T-Bill; Sector returns displayed in the chart represent S&P 500 sectors, while treasury benchmarks are from Barclays

Quote of the Month

“In investing, what is comfortable is rarely profitable.”