Market Perspectives – September 2017

Capital Markets

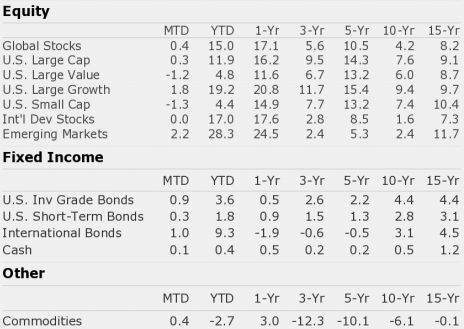

August is historically one of the slowest market months of the year, and this year it was no different. As investors closed out their summer vacations, the stock market stayed put. Within the markets, growth beat value, large beat small, and emerging markets beat all other asset classes at 2.2%. If you have been reading Market Perspectives over the last few months, you know that these leadership themes have persisted throughout 2017.

Two major events at the end of the month, the historic landfall of Hurricane Harvey in the Gulf and North Korea’s decision to fire a missile over Japan, seemed to do little to scare the markets. These two events represent very different risks. In the case of Harvey, the economic damage on a local basis will be tremendous. Our economic research partners believe that a slowdown in Houston will last a few months and will only have a small impact on U.S. GDP. Hurricanes tend to damage certain sectors of the local economy while helping others. As for North Korea, the looming threat of a full-scale war against North Korea is a major risk for markets. Markets have largely shrugged off the threat, although recent price action shows a clear concern as North Korea threatens the use of nuclear weapons.

Bond markets have continued to perform well this year as interest rates have moved downward slightly, despite the Fed raising short-term rates twice. The yield curve flattened again in August as investors seem less willing to bet that inflation will raise its head. Historically speaking, it’s not surprising to see the curve flatten during the Fed’s interest rate tightening period; but given the pending announcement that the Fed might begin to sell down its longer-dated bonds on the balance sheet, we would have expected rates to be higher than current levels. Members of the Fed will be quite disappointed if future rate hikes and balance sheet reductions lead to lower long-term interest rates and higher short-term rates.

September will prove to be a busy month in the markets as traders and investors come back from their vacations. We will receive a full dose of economic data, the Fed will meet and provide an announcement, and hurricane season will be in full swing. We’ve had a great run so far in 2017, and we wouldn’t be surprised to see a temporary pullback in coming weeks.

The Great Unwind

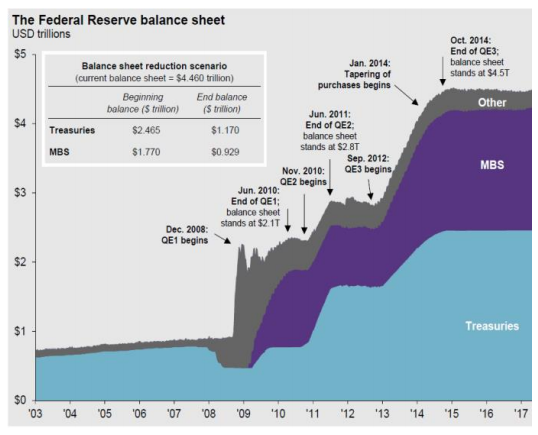

In the coming days, investors will turn their attention to the announcement from the September meeting of the Federal Reserve. Since June, the Fed has increasingly discussed the prospect of beginning to “unwind its balance sheet.” This topic is sure to lead to doomsday predictions and other misinformation coming from the predictable talking heads. Here are our thoughts on the pending announcement:

- During the 2008 financial crisis, the Fed began a multi-year quantitative easing (QE) program in hopes of turning around the crisis.

- The process of QE included purchasing treasury bonds and securitized mortgages over a series of years in an attempt to lower interest rates across the yield curve and to force investors into riskier securities.

- The Fed bought trillions of dollars’ worth of bonds, injecting unprecedented amounts of capital into the veins of the economy.

- The Fed’s balance sheet (amount of bonds it holds currently) totals about $4.5T today, and the Fed has been maintaining this level for years.

- The pending announcement will lead to a multi-year process for shrinking the balance sheet through bond maturities and through actively selling bonds.

- Some will argue that this spells trouble for bonds and predict that interest rates rise dramatically. We doubt it.

- We expect the Fed to err on the side of caution and go extremely slowly. Further, if the Fed goes too fast we believe that riskier securities like high yield bonds, stocks, and real estate would get hurt worse as investors flee into U.S. Treasuries as a safe haven.

- Economic cycles are part of life. We are probably near the end of an expansion. The Fed could very well have a hand in causing the next downturn. But we don’t see the upcoming news as a reason to panic.

- When the next downturn occurs, we think it’s unlikely that high-quality bonds will be the asset class that experiences the greatest damage.

- We expect the Fed to err on the side of caution and go extremely slowly. Further, if the Fed goes too fast we believe that riskier securities like high yield bonds, stocks, and real estate would get hurt worse as investors flee into U.S. Treasuries as a safe haven.

- Economic cycles are part of life. We are probably near the end of an expansion. The Fed could very well have a hand in causing the next downturn. But we don’t see the upcoming news as a reason to panic.

- When the next downturn occurs, we think it’s unlikely that high quality bonds will be the asset class that experiences the greatest damage.

The information published herein is provided for informational purposes only, and does not constitute an offer, solicitation or recommendation to sell or an offer to buy securities, investment products or investment advisory services. All information, views, opinions and estimates are subject to change or correction without notice. Nothing contained herein constitutes financial, legal, tax, or other advice. The appropriateness of an investment or strategy will depend on an investor’s circumstances and objectives. These opinions may not fit to your financial status, risk and return preferences. Investment recommendations may change and readers are urged to check with their investment advisors before making any investment decisions. Information provided is based on public information, by sources believed to be reliable but we cannot attest to its accuracy. Estimates of future performance are based on assumptions that may not be realized. Past performance is not necessarily indicative of future returns. The following indexes were used as proxies in the performance tables: Global Stocks = MSCI ACWI; U.S. Large Cap = S&P 500; U.S. Large Value = Russell 1000 Value; U.S. Large Growth = Russell 1000 Growth; U.S. Small Cap = Russell 2000; Int’l Dev Stocks = MSCI EAFE; Emerging Markets = MSCI EM; U.S. Inv Grade Bonds = Barclays U.S. Aggregate; U.S. High Yield Bonds = Barclays Corporate High Yield; Emerging Markets Debt = JPMorgan EMBI Global Diversified; Int’l Bonds = Barclays Global Treasury ex US; Cash = 3month T-Bill; Sector returns displayed in the chart represent S&P 500 sectors, while treasury benchmarks are from Barclays

Quote of the Month

“Trying to reason with Hurricane Season”