COVID-19: Keep Calm

Market Perspectives – February 2020

February 11, 2020

Market Perspectives – March 2020

March 10, 2020

By: Robert R. Shaw

The COVID-19 coronavirus outbreak is driving fear and market volatility in China and throughout the world.

Why are people scared?

Global financial markets have reacted strongly to this previously unknown disease and fears of an uncontrollable global pandemic. Fear is especially high after news of confirmed cases and deaths outside of China in Asia, the Middle East, Europe, and the Americas.

An opinion piece this month in the International Journal of Epidemiology summarized well the reasons COVID-19 is spreading so quickly compared to SARS coronavirus in 2002 and MERS coronavirus in 2012:

Compared with SARS and MERS, COVID-19 has spread more rapidly, due in part to increased globalization and the focus of the epidemic. Wuhan, China is a large hub connecting the North, South, East and West of China via railways and a major international airport. The availability of connecting flights, the timing of the outbreak during the Chinese (Lunar) New Year, and the massive rail transit hub located in Wuhan has enabled the virus to perforate throughout China, and eventually, globally.1

Is the sky falling?

While there is obvious cause for concern, this incident has not moved the needle on long-term trends that drive the global economy, such as the development and adoption of technology, the globalization of trade, and changing population demographics. The same has been true of past viral epidemics that caused similar fears and market volatility.

In the past twenty-five years, the world has seen frightening outbreaks of H5N1 Avian Flu, West Nile Virus, SARS coronavirus, H1N1 Swine Flu, MERS coronavirus, H7N9 Avian Flu, West Africa Ebola Virus, Zika virus, and now COVID-19 coronavirus. Each of those was largely resolved within a year of their respective beginnings, and markets recovered even before the outbreaks were officially over. In every case, short-term disruptions to supply chains and other business activity were quickly resolved, and US stock markets had positive returns six months after the virus first appeared.

Are people overreacting?

Strong responses to the current outbreak by public health officials are informed by these past events and are intended to limit the spread of disease. Quarantine and contact restrictions such as canceling planned travel, closing schools or businesses, and blocking transportation routes may seem drastic and may further stoke fears and market volatility. Nevertheless, it is encouraging to see them implemented. Like the emergency brakes on a runaway train, these proven strategies may be momentarily jarring but ultimately lifesaving.

What should investors do?

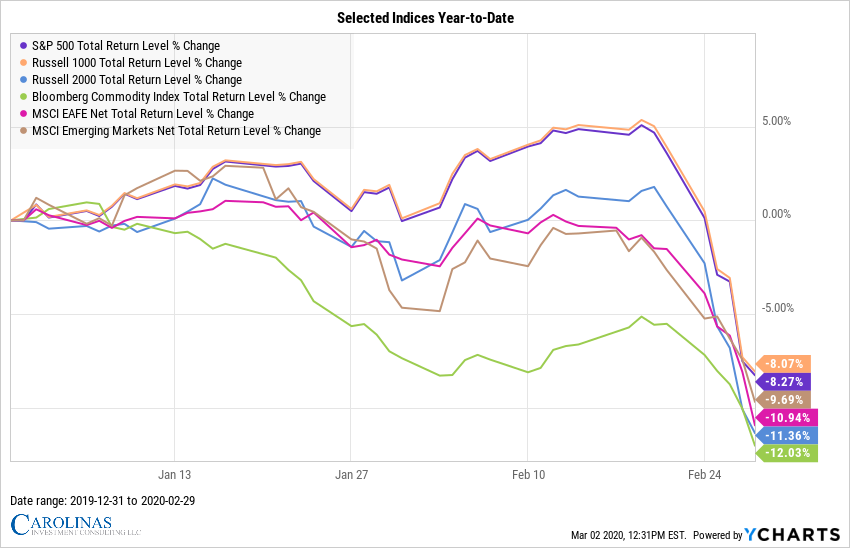

If the past is any guide, investors should keep calm and stick to their plans. Realize that times like these are the reason investment advisers spend so much effort on managing risk. If equity and commodity declines steepen, there may be opportunities for rebalancing within diversified portfolios or putting cash to work.

1International Journal of Epidemiology, 2020, 1-10. 2020 Feb 22. pii: dyaa033. doi: 10.1093/ije/dyaa033. [Epub ahead of print] (https://www.ncbi.nlm.nih.gov/pubmed/32086938)

Robert R. Shaw is an investment consultant in Charlotte, NC. Robert creates tailored investment portfolios for institutions and wealthy families together with comprehensive plans for lasting financial success. Click here to learn more about Robert and how he can help you.

Carolinas Investment Consulting is not affiliated with any of the websites linked in this commentary. Nothing contained herein constitutes financial, legal, tax, or other advice. The views and opinions expressed in this article are those of the author and do not necessarily reflect the official policy or position of Carolinas Investment Consulting. The information published herein is provided for informational purposes only, and does not constitute an offer, solicitation or recommendation to sell or an offer to buy securities, investment products or investment advisory services. All information, views, opinions and estimates are subject to change or correction without notice. The appropriateness of an investment or strategy will depend on an investor’s circumstances and objectives. These opinions may not fit to your financial status, risk and return preferences. Past performance is not indicative of future returns.