Feeling the Rise in Gas and Food Prices

Market Perspectives March 2022

March 11, 2022

Market Perspectives April 2022

April 7, 2022

Inflation continues to be the topic of conversation, especially since Russia’s attack on Ukraine. The effects from the geopolitical war can be felt locally, as you pay at the gas pumps and checkout at supermarkets. The prices of gasoline and crude oil have increased since Russia’s invasion, with both Brent Crude and the West Texas Intermediate oil prices going up.

Below is a graph that shows the price changes in crude oil. Click here if you would like to learn more about the data in this graph.

Gasoline prices have taken a record surge and continue to rise as the war wages on. There was already a higher call for oil in the United States compared to the current supply, as we are getting back to pre-COVID demand levels. Based on the U.S. Energy Information Administration on Monday, March 14, the increase in national demand for oil can be seen in the rise of the average price per gallon for gasoline. If you are interested to learn more, click here.

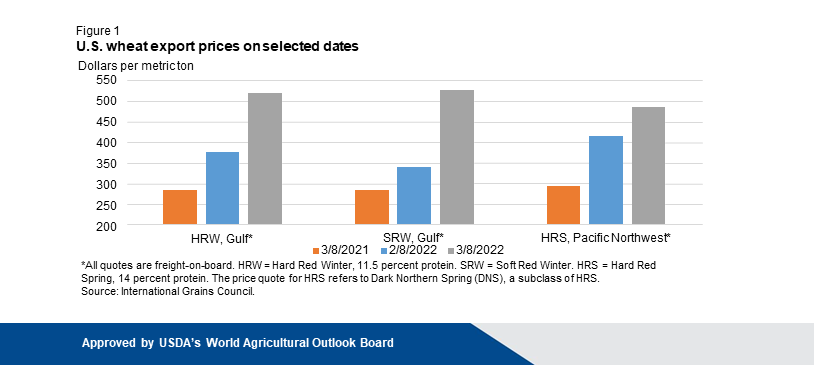

In addition to gasoline, food prices have slowly begun to rise. Russia and Ukraine are major exporters of wheat, and the war may impact the trade production in both countries. According to the U.S. Department of Agriculture, Russia exports 12% of the world’s wheat and Ukraine exports about 16%. Since the war is still ongoing, we are starting to see an increase in food and wheat exportation prices in the United States. If you would like to read more, click here.

As we enter the fourth week since Russia’s first strike on Ukraine, changes in our country’s commodity prices are imminent as the world watches in hope that the war comes to an end soon.

Mary Alex Edmiston is the Marketing and Communications Coordinator at Carolinas Investment Consulting.

Carolinas Investment Consulting is not affiliated with any of the websites linked in this commentary. Nothing contained herein constitutes financial, legal, tax, or other advice. The views and opinions expressed in this article are those of the author and do not necessarily reflect the official policy or position of Carolinas Investment Consulting. The information published herein is provided for informational purposes only, and does not constitute an offer, solicitation or recommendation to sell or an offer to buy securities, investment products or investment advisory services. All information, views, opinions and estimates are subject to change or correction without notice. The appropriateness of an investment or strategy will depend on an investor’s circumstances and objectives. These opinions may not fit to your financial status, risk and return preferences. Past performance is not indicative of future returns.

Sources: U.S. Energy Information Administration and the U.S. Department of Agriculture