Tax Benefits of a Health Savings Account

Market Perspectives – November 2018

November 7, 2018

Better Ways to Give to Charity

November 20, 2018

By: Abby Bennett, CFP®

A health savings account (HSA) is designed to allow taxpayers in the US to save tax-deferred money specifically for medical expenses. It is arguably the most tax-advantaged savings account available today. Unlike a Flexible Spending Account, you don’t lose the funds in your HSA at year-end – the account is yours to keep, regardless of how much you use in any given year. This means the account can continue to grow through additional contributions, may earn interest, and can even be invested, all while maintaining its powerful tax benefits.

More detailed information can be found in this IRS publication.

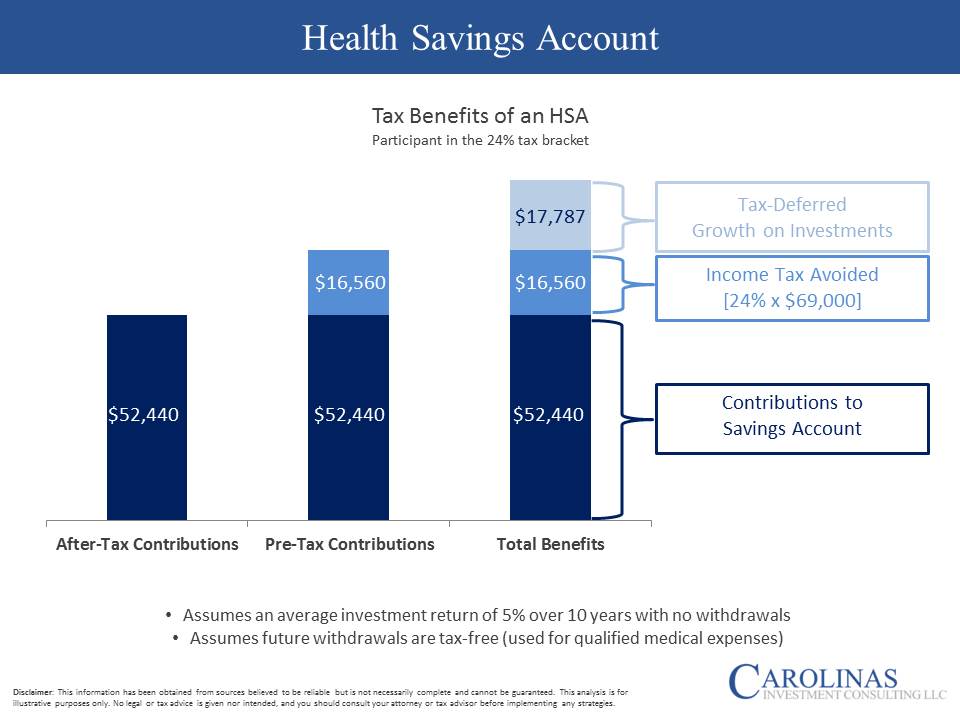

Tax Benefits of an HSA

The HSA offers a trifecta of tax benefits: contributions to the account are tax-deductible, the growth on the account is tax-deferred, and if you withdraw the funds only for qualified medical expenses, the withdrawals are tax-free. In other words, if you follow the rules, the tax man doesn’t touch your HSA savings.

If you don’t follow the rules and use funds from your account to pay for anything other than qualified medical expenses, you’ll pay ordinary income tax on the entire amount withdrawn. If you’re under age 65, you’ll also pay an additional 20% penalty.

Great! How do I get an HSA?

Health savings accounts are only available to individuals and families covered under a qualifying high-deductible health plan (HDHP) – not all high-deductible plans are the same, nor do they all come with HSA eligibility, so be sure to do your homework.

Many employers offer an HSA-eligible option under their group plan, so it may be worth looking into your options at your next annual benefits renewal. If you’re not covered under an employer plan, you may be able to access an HSA-eligible plan via the health insurance marketplace. However, be sure to understand the trade-offs between an HSA-eligible plan and other, lower deductible plan options – make sure your coverage under any plan is appropriate for you and your family. Once you are covered under a qualifying HDHP, the health savings account can be opened with an approved trustee at an institution such as a bank.

I have an HSA. How do I contribute?

If you’re covered under an employer-sponsored plan, your contributions may be made out of your paycheck on a pre-tax basis. Just like your Traditional 401(k) contributions, HSA contributions made this way reduce your reportable wages so there is no need to deduct them on your tax return. If you contribute directly to your HSA, as opposed to having your employer withhold contributions from your paycheck, you are able to deduct the entire amount on your tax return.

You can make contributions to your HSA at any time during the year, up until April 15th of the following year, like an IRA contribution. The entire amount (up to the annual limit) is tax-deductible, regardless of income. In fact, someone else can contribute to your HSA as a gift to you and you still get the tax deduction.

Are there contribution limits?

The 2018 annual contribution limit for individual coverage is $3,450. The annual limit for qualified family coverage is $6,900. If you’re age 55 or older, that limit is increased by $1,000. However, the maximum amount you can contribute may vary depending on the months you were considered eligible in any given year.

If total contributions to an HSA exceed the annual limit, all excess contributions are subject to a 6% excise tax.

I have a qualified medical expense. Should I take the money out of my HSA?

If you have incurred a qualified medical expense, you can take the funds out of your HSA tax-free and penalty-free to cover the expense. However, if you can afford to cover the expense out of pocket (leaving the funds in the HSA), that may be a better strategy.

Because HSAs can accumulate funds year after year and be invested, you are able to treat the account like a retirement-savings vehicle. Unlike Individual Retirement Accounts (IRAs), you can contribute the maximum to an HSA regardless of income and are not required to make any withdrawals during your lifetime.

If you contribute the family maximum (assuming it doesn’t change) for 10 years and earn a 5% average return over that time period, your account’s future value could be over $85,000, which could then be used on a tax-free basis for qualified medical expenses.

Keep in mind, there are risks associated with investing, including the risk of losing money, which should be considered before implementing any strategy.

I’m age 65. Should I take the money out of my HSA?

Once you reach age 65, the 20% penalty attributed to withdrawals for non-qualified expenses goes away. In essence, this turns your health savings account into a Traditional IRA with an extra tax benefit around medical expenses but without the burden of required distributions. This gives you flexibility to pay for medical care without increasing your taxable income in retirement (unlike an IRA withdrawal which would increase your taxable income), while also allowing you to pay for other living expenses without penalty, if needed.

To HSA, or not to HSA?

The answer is, “it depends”. For those who are healthy, have low annual medical expenses, or feel comfortable paying for health care expenses out of cash flow, it may be worth looking into. Even if you use funds from the account every year, you could avoid taxes you may have otherwise paid. However, if your health situation is such that it’s better to pay higher premiums and have a lower deductible, or your current plan has better coverage or is much more affordable without HSA-eligibility, making the change may not be appropriate. Just like any other strategy, individual situations differ so you should consider your options carefully.

Abby Bennett, CFP® is a financial planner in Charlotte, NC. She provides financial advice to families and business owners, and specializes in financial planning for engineers and tech professionals. Click here to learn more about Abby.

Nothing contained herein constitutes financial, legal, tax, or other advice. The views and opinions expressed in this article are those of the author and do not necessarily reflect the official policy or position of Carolinas Investment Consulting. The information published herein is provided for informational purposes only, and does not constitute an offer, solicitation or recommendation to sell or an offer to buy securities, investment products or investment advisory services. All information, views, opinions and estimates are subject to change or correction without notice. The appropriateness of an investment or strategy will depend on an investor’s circumstances and objectives. These opinions may not fit to your financial status, risk and return preferences. Past performance is not indicative of future returns.