Market Perspectives – May 2018

Capital Markets

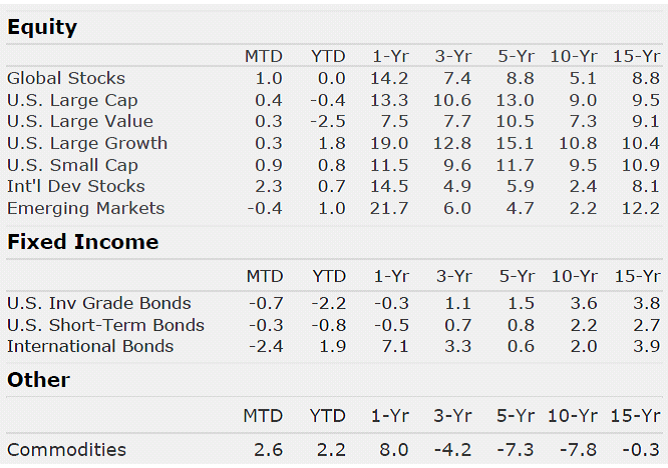

After back-to-back negative months, the stock market notched a modest gain in April. The U.S. stock market remains largely flat for 2018 so far, after a year of historically low volatility and more than 20% returns. Since the market high on January 26th we have seen two separate bottoms in the S&P 500, each at 2,581, or just over a 10% correction.

A 10% correction is typical. It is actually less than the average correction in a typical year (14% is the average drop in a given year). However, as companies beat earnings and stocks drop, it begs the question, is this just a correction or is it the end of the 10-year bull market? A few thoughts:

- The short answer is that we are neutral in our outlook.

- Economic data in the U.S. is still quite strong and in some ways getting stronger.

- International economic data has sputtered a bit but remains very healthy.

- Earnings have surpassed very high expectations in Q1, the first readings after the new tax law. Earnings momentum is extremely healthy and could propel stocks higher.

- High yield bonds have largely held up well this year. In recent prolonged bear markets and severe drawdowns, we have observed that high yield bonds have strongly underperformed the stock market at the end of the cycle. So far this time, credit has done very well.

- All past Fed rate hike cycles have led to recessions, and we are now well into the Fed tightening cycle. Each of these recessions has led to an inversion of the yield curve (meaning short-term rates pay higher interest rates than longer term rates).

- While the curve hasn’t inverted, the flattening of the curve should be watched closely.

- Inflation readings are still below target. Much of the concern that led to this correction was related to inflation. While inflation may pick up on a cyclical basis the readings are well below levels that would be concerning.

- As we have suggested previously we forecast lower returns over the next 5 to 7 years. While some pockets of the capital markets appear highly overvalued, others appear fairly valued.

It’s very plausible the bull market will continue on beyond this minor correction but investors should watch interest rates and high yield bonds carefully as they may offer some insight. Either way, reaching for risk would not be advised at this juncture.

Is Value Investing Dead?

If Benjamin Graham is the father of value investing, Eugene Fama and Kenneth French are its greatest historians. Fama and French, in their seminal 1993 paper, identified what is now called the “value premium”. The value premium refers to a now commonly understood idea that value stocks (those with low prices relative to their book values) will produce better returns than those with high prices relative to their book values.

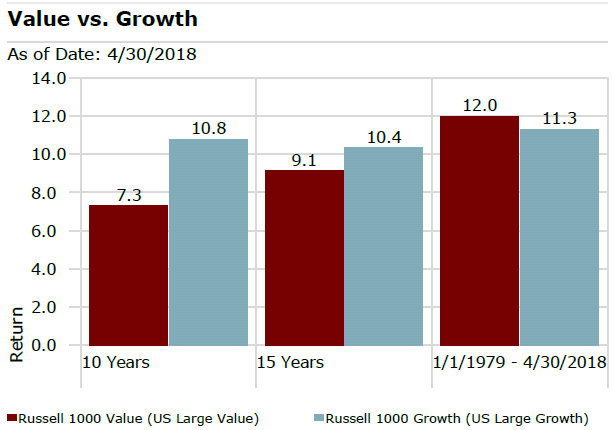

In going back to the beginning of the Russell 1000 Index (1979), value stocks have beaten growth stocks. They have actually beaten by 0.7% per year over that time. Other studies have shown that the value premium is even more extreme when we go back further.

However, returns for value stocks have strongly underperformed growth stocks lately. In fact, as of 04/30/2018, growth stocks have beaten value stocks over the year-to-date, 1-year, 3-year, 5-year, 10-year, and 15-year periods.

Growth stocks now dominate the top 10 names of the stock market. Facebook, Amazon, Google, and Netflix made up just 3% of the overall stock market in 2012 but account for nearly 12% today! We have also observed that finding a good value manager is harder than ever. When we screen fund managers for value metrics we find that many of the best performers haven’t been investing in value stocks! This begs the question: is value investing dead? In short, no, we don’t think so.

We suspect that value will beat growth over the next decade. Many of the top performing growth stocks are now trading at extreme multiples to earnings, cash flow, and book value. Yes, many of the stocks are very good companies and many are disrupting traditional value industries. But markets and life have a way of surprising us. We don’t know what will be the catalyst for turning the tide from growth to value, but we suspect there will be one. Perhaps rising rates will be the catalyst. Or maybe government regulation of the hot industries will do it. Growth stocks may have more upside from here, but we suggest it wise to proceed with caution.

By: Dustin Barr, CFA

All data sourced from Morningstar Direct unless otherwise noted. The information published herein is provided for informational purposes only, and does not constitute an offer, solicitation or recommendation to sell or an offer to buy securities, investment products or investment advisory services. All information, views, opinions and estimates are subject to change or correction without notice. Nothing contained herein constitutes financial, legal, tax, or other advice. The appropriateness of an investment or strategy will depend on an investor’s circumstances and objectives. These opinions may not fit to your financial status, risk and return preferences. Investment recommendations may change and readers are urged to check with their investment advisors before making any investment decisions. Information provided is based on public information, by sources believed to be reliable but we cannot attest to its accuracy. Estimates of future performance are based on assumptions that may not be realized. Past performance is not necessarily indicative of future returns. The following indexes were used as proxies in the performance tables: Global Stocks = MSCI ACWI; U.S. Large Cap = S&P 500; U.S. Large Value = Russell 1000 Value; U.S. Large Growth = Russell 1000 Growth; U.S. Small Cap = Russell 2000; Int’l Dev Stocks = MSCI EAFE; Emerging Markets = MSCI EM; U.S. Inv Grade Bonds = Barclays U.S. Aggregate; U.S. High Yield Bonds = Barclays Corporate High Yield; Emerging Markets Debt = JPMorgan EMBI Global Diversified; Int’l Bonds = Barclays Global Treasury ex US; Cash = 3month T-Bill; Sector returns displayed in the chart represent S&P 500 sectors, while treasury benchmarks are from Barclays

Quote of the Month

“The single advantage a value investor has is not I.Q. It’s patience and waiting.”

Mohnish Pabrai – Famed Value Investor