Market Perspectives – July 2018

Capital Markets

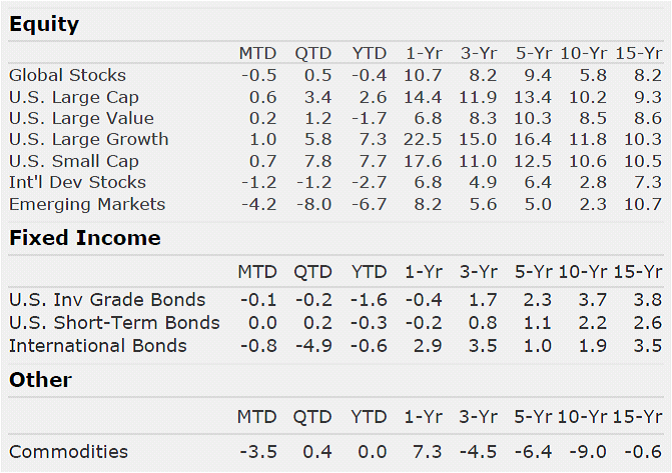

Markets remained choppy throughout the quarter with global stocks posting a modest return. U.S. leadership remained strong with a positive 3.4% return for large caps, driven mainly by mega cap tech. Small cap stocks rose strongly on the quarter as they remained more insulated from many of the fears around tariffs and a global trade war. Conversely, international stocks and emerging markets stocks struggled as the U.S. dollar strengthened and geopolitical stability concerns rose.

Growth stocks led the way over value stocks. This was true in the U.S. and in international markets. Growth leadership has been persistent for many years now. Large cap growth stocks beat their value brethren by 4.6% on the quarter and have outpaced value by 6.1% per year for 5 years, a remarkable feat.

The Fed raised rates by a quarter point in June as it continues its exit strategy. Longer-term rates have remained stubbornly low despite positive economic data, tight labor markets, and early signs of inflation upticks. The 10-year yield rose on the quarter from 2.73% to 2.83%, but the 2-year yield began the quarter at 2.08% and has jumped to 2.52%. The difference between the longer-term 10-year and the short-term 2-year sits at just 31 basis points. Another Fed rate increase, coupled with a slight reduction in the 10-year, could invert the curve. We have long argued that the Fed would be very careful not to invert the curve. However, new Chairman Powell seems to be more focused on taking a hawkish stance than his predecessor Chairwoman Yellen. Commentary from Fed officials has been notably hawkish.

As yields rise and the curve flattens, we continue to argue for a higher quality, short duration bias in fixed income portfolios. Fixed income continues to have low expected returns, but as the yield curve flattens and credit spreads remain tight one must ask whether investors are being compensated appropriately to take additional interest rate or credit risk.

The most challenging aspect of investing money in this environment is the fact that nearly every high returning asset class appears to have a lower than average longer-term expected return. Meanwhile, cash still doesn’t provide a positive real return. In such an environment, it seems dangerous to reach for return in esoteric or alternative areas. A more prudent approach is to diversify your portfolio and participate in economic growth while maintaining sufficient liquidity and dry powder to further employ at more attractive levels.

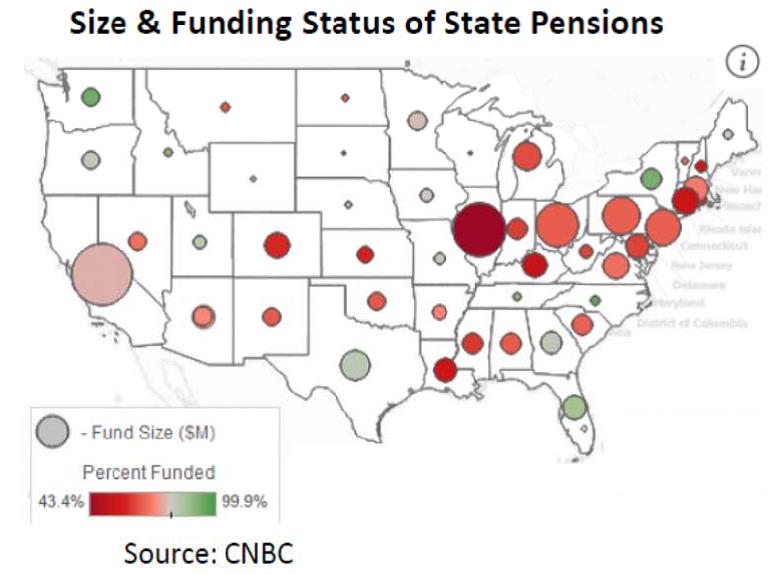

Many Pension Funds Will Be Insolvent in the Next 30 Years

The woes of the U.S. defined benefit pension system have been underreported. The coming pension crisis may have real implications; a few thoughts:

- For decades government employees were offered the benefit of having a defined benefit pension. Employees are paid after they retire based on their tenure and past salary.

- When used correctly, pensions are a great idea. Employers fund (similar to the match on the 401(k)) an employee’s pension by putting money into the large pension fund. The money is invested with the goal of having enough money to pay all of the employees in the future.

- Sadly, the U.S. pension system is very underfunded. Politicians have underfunded pensions for years. One way that they have masked the problem is to assume high future returns. Many pensions still use an 8% return target in their modeling, yet the real expected returns of their portfolios are likely well below 8%.

- Even assuming such lofty returns, 21 state pensions were underfunded by at least 30% as of 2017. Only two were fully funded. Cutting future returns only make the picture look worse.

- To make matters worse, pension funds have notoriously exhibited bad investment behavior. Today, they are continuing to pile into alternative investments. In 2006, they piled into stocks and then sold in 2009.

- When these funds become insolvent, there will be just a few options: bankruptcy restructuring, massive budget cuts, a Federal government bailout through fiscal or monetary policy, or higher tax rates.

- The reality is that all of these options will likely impede economic growth in the future.

- Pensions, debt levels, and aging demographics are reasons we expect lower long-term economic growth and lower expected returns. This is not inherently a bad thing as long as we anticipate lower returns and plan accordingly. Establishing a prudent savings plan and investment approach will be even more critical in a low return, low growth environment.

By: Dustin Barr, CFA

All data sourced from Morningstar Direct unless otherwise noted. The information published herein is provided for informational purposes only, and does not constitute an offer, solicitation or recommendation to sell or an offer to buy securities, investment products or investment advisory services. All information, views, opinions and estimates are subject to change or correction without notice. Nothing contained herein constitutes financial, legal, tax, or other advice. The appropriateness of an investment or strategy will depend on an investor’s circumstances and objectives. These opinions may not fit to your financial status, risk and return preferences. Investment recommendations may change and readers are urged to check with their investment advisors before making any investment decisions. Information provided is based on public information, by sources believed to be reliable but we cannot attest to its accuracy. Estimates of future performance are based on assumptions that may not be realized. Past performance is not necessarily indicative of future returns. The following indexes were used as proxies in the performance tables: Global Stocks = MSCI ACWI; U.S. Large Cap = S&P 500; U.S. Large Value = Russell 1000 Value; U.S. Large Growth = Russell 1000 Growth; U.S. Small Cap = Russell 2000; Int’l Dev Stocks = MSCI EAFE; Emerging Markets = MSCI EM; U.S. Inv Grade Bonds = Barclays U.S. Aggregate; U.S. High Yield Bonds = Barclays Corporate High Yield; Emerging Markets Debt = JPMorgan EMBI Global Diversified; Int’l Bonds = Barclays Global Treasury ex US; Cash = 3month T-Bill; Sector returns displayed in the chart represent S&P 500 sectors, while treasury benchmarks are from Barclays

Quote of the Month

“Financial peace isn’t the acquisition of stuff. It’s learning to live on less than you make, so you can give money back and have money to invest. You can’t win until you do this.”

Dave Ramsey