Market Perspectives – June 2018

Capital Markets

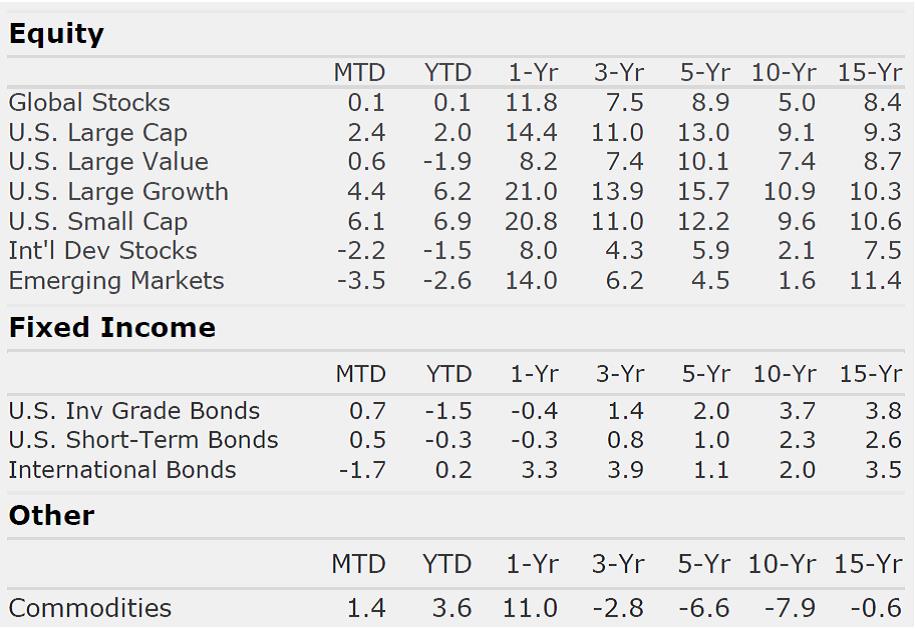

May was an interesting month in the markets. After a year of dollar depreciation and stock leadership abroad, markets reversed sharply. U.S. stocks posted strong returns with small cap and growth stocks leading the way. Despite under performing their growth counterparts, U.S. value stocks posted positive returns. Meanwhile, the value of the dollar increased, fixed income yields fell, and foreign stocks were punished in the month.

Three key topics seem to be driving the negative sentiment abroad:

- Increased trade tensions and tariffs between the U.S. and foreign trading partners, notably Mexico, Europe, and China

- Risk of political instability in Italy and ramifications for European sovereign debt and the Euro currency

- Pending North Korea summit and the drama leading up to the possible meeting (this will be interesting to watch but we have no commentary on risks at this juncture)

In the Market Perspectives, we have acknowledged multiple times that tariffs present a danger for a trade war. History tells us that trade wars have almost always ended in significant pain and have rarely led to a “winner.” We have remained hopeful that the tariffs are more “bark” than “bite” and that the end game is bringing key trading partners to the table to address specific issues such as intellectual property law. Time will tell if our hopes will come true. The renewed rounds of tariffs have clearly concerned international markets and have sent shock waves across these recovering economies.

It’s de ja vu all over again for Europe as we revisit debt fears and the breakup of the EU discussion. 2011 presented a very real possibility of a crisis in Europe and 2015 saw renewed fears from Greece on the same topic. While we are not experts on Italy, clearly the momentum of nationalistic populist movements has gained steam across the developed world over the last few years. A breakup of the Euro as a currency would have very real and lasting effects on European and Global economies. It’s far too early to understand whether fears of an Italian exit are overblown. Similar to Greece’s economy, Italy’s economy is small relative to the larger EU countries. Additionally, many of the largest Italian companies derive most of their revenue outside of Italy which could present an opportunity if Italy were to change currencies.

Inside the U.S., economic data continues to be solid. On June 1st, a banner jobs number helped shift sentiment positive. The U.S. economy is currently firing on all cylinders in the 10th year of the economic recovery.

One of the Most Misunderstood Aspects of Investing

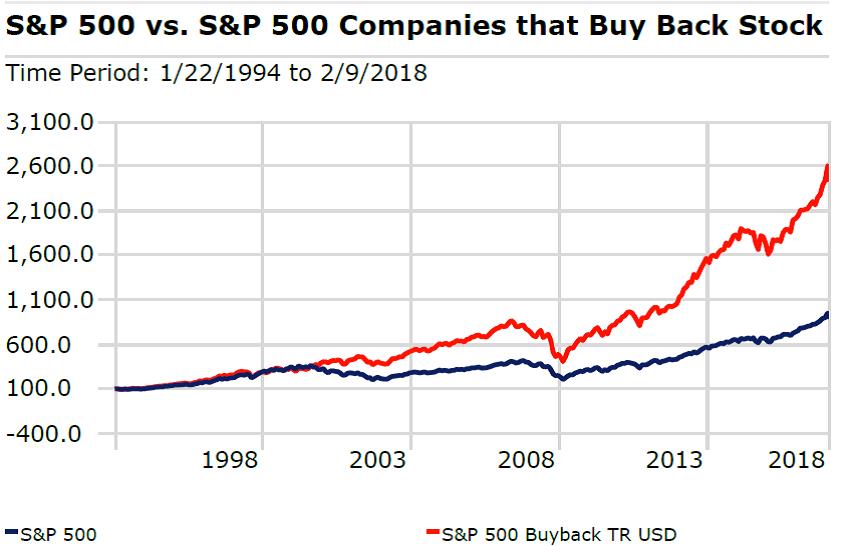

Over the last few years there have been a lot of articles published about share buybacks. Some articles alleged they were the only reason stocks were going higher and others have alleged that CEOs are misallocating capital using share repurchases and thus are committing some form of fiduciary malfeasance. These types of statements are hyperbolic. In an attempt to clarify, we offer our thoughts:

- One of the most important roles of a CEO is to allocate capital. A CEO has just five tools they can use to allocate their free cash flow: pay down debt, new capital investments, acquisition of a company, offer a dividend to shareholders, or buy back shares of stock.

- Quant firm Alpha Architect recently highlighted that firms that buy their own stock rather than using cash flow for mergers or expansion have delivered higher returns. Empire building CEOs may tend to misallocate capital through acquisitions.

- When CEOs decide to return cash flow to investors they can either do this through dividends or buybacks. Buybacks are a more favorable way to return capital to shareholders. Shareholders that hold the stock in taxable accounts can decide when to realize gains. Capital gains tax rates tend to be more favorable than dividends.

- In the book “The Outsiders,” author Will Thorndike explores attributes of the CEOs who delivered out sized returns to their investors over long periods of time. Nearly every CEO used buybacks tactically, particularly when their stocks become undervalued. Very few of these CEOs used recurring dividends as a tool for capital allocation.

- To be clear, CEOs can make very poor allocation decisions by buying back shares. A number of CEOs have elected to borrow money to buy back shares after their stock has compounded at a strong rate. This could lead to a very bad outcome.

- In summary, buybacks are misunderstood. Calls to ban buybacks are misguided and those that favor dividend stocks in taxable accounts might be better served thinking about share buybacks in the same light as dividends. Total return is more important than dividends.

By: Dustin Barr, CFA

All data sourced from Morningstar Direct unless otherwise noted. The information published herein is provided for informational purposes only, and does not constitute an offer, solicitation or recommendation to sell or an offer to buy securities, investment products or investment advisory services. All information, views, opinions and estimates are subject to change or correction without notice. Nothing contained herein constitutes financial, legal, tax, or other advice. The appropriateness of an investment or strategy will depend on an investor’s circumstances and objectives. These opinions may not fit to your financial status, risk and return preferences. Investment recommendations may change and readers are urged to check with their investment advisors before making any investment decisions. Information provided is based on public information, by sources believed to be reliable but we cannot attest to its accuracy. Estimates of future performance are based on assumptions that may not be realized. Past performance is not necessarily indicative of future returns. The following indexes were used as proxies in the performance tables: Global Stocks = MSCI ACWI; U.S. Large Cap = S&P 500; U.S. Large Value = Russell 1000 Value; U.S. Large Growth = Russell 1000 Growth; U.S. Small Cap = Russell 2000; Int’l Dev Stocks = MSCI EAFE; Emerging Markets = MSCI EM; U.S. Inv Grade Bonds = Barclays U.S. Aggregate; U.S. High Yield Bonds = Barclays Corporate High Yield; Emerging Markets Debt = JPMorgan EMBI Global Diversified; Int’l Bonds = Barclays Global Treasury ex US; Cash = 3month T-Bill; Sector returns displayed in the chart represent S&P 500 sectors, while treasury benchmarks are from Barclays

Quote of the Month

“When examining the cross-section of stock returns, on average, stock buybacks are good for investors – this is not a disputed fact.”

Wes Gray – Quant Investor