Market Perspectives – December 2017

Capital Markets

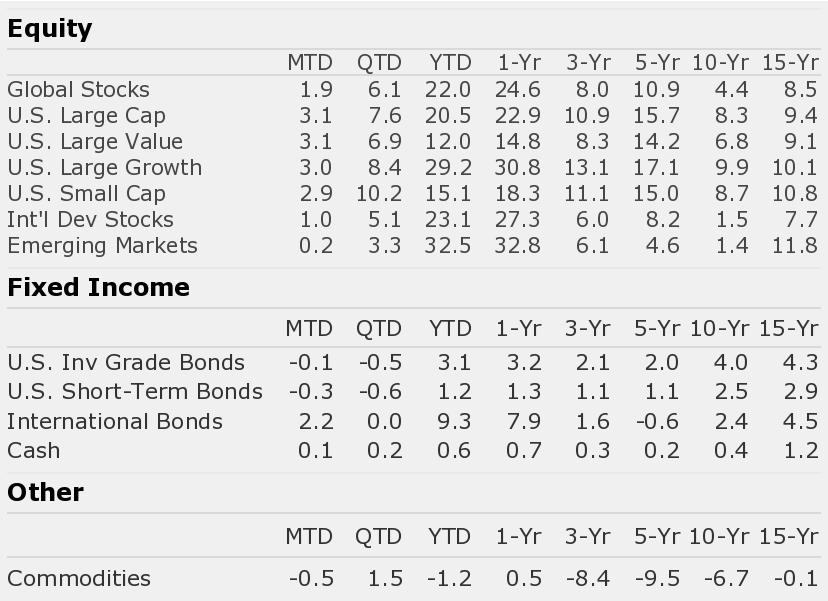

The stock market’s winning streak extended for another month in November as U.S. stocks posted strong gains. The “risk-on” environment largely played out across asset classes as riskier assets posted solid gains, while risk-averse asset classes such as high-quality bonds slipped.

We have wondered aloud in these pages previously that while valuations are high, conditions could be present for a stock market “melt-up.” November certainly did nothing to quash such an idea. Price action has been soundly positive for most days this year and volatility has remained near historic lows throughout 2017.

Wall Street’s focus largely turned to Washington, D.C. in November as President Trump and Congressional GOP leadership worked to create sweeping and comprehensive tax legislation. In the early morning of December 2nd, the Senate passed their version of the tax bill. The House and Senate bills will now have to be reconciled before placing the legislation on President Trump’s desk. It seems highly likely the committee will come to an agreement.

We have been asked recently whether we think the impact of tax reform was already built into the price of stocks. It’s hard to know for sure, but we suspect the market hasn’t fully priced in the tax reform. Goldman Sachs developed a high tax and low tax basket of stocks last year to watch the impacts of tax reform. So far in 2017, the companies that pay high taxes and stand to benefit the most from the tax cuts have underperformed those that will benefit the least. This metric and others lead us to believe a cut in statutory corporate tax rates from 35% to 20% coupled with the ability for companies to immediately expense capital expenditures should have a favorable impact on the price of stocks in the short-run.

We remain cautious on the expected return of stocks in the coming 5 years but current conditions seem to strongly favor higher highs in the months to come.

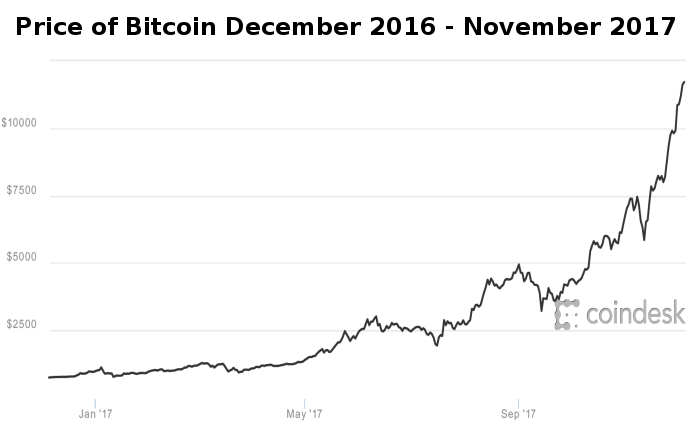

Bitcoin Mania

I first investigated Bitcoin in fall of 2015 after a conference. The price of Bitcoin at that time was around $225 and has surged past 11,000 as of month-end. Here are my thoughts on Bitcoin:

- The concept of Bitcoin was created in 2008 when Satoshi Nakamoto (an unknown person) published a white paper conceiving a digital currency that would allow individuals to make electronic payments to one another online without going through a financial institution or trusted intermediary.

- The white paper conceptualized a new underlying technology called “blockchain,” a massive accounting ledger that runs on an open source internet protocol. Rather than having a bank or trusted third party verify a transaction, the marketplace verifies the transaction. Supercomputers, called “miners,” compete with one another to verify the transaction. Miners are rewarded in tokens called “Bitcoins” for verifying the transaction.

- There are new tokens issued each time verification takes place, but there are a finite number of tokens that can ever be issued (21 million Bitcoins).

- In recent weeks, as the price of Bitcoin has soared at a rapid pace, the world has taken notice. Well known investors and bankers such as Jamie Dimon and Howard Marks have argued Bitcoin is a bubble. Other investors, such as value investor Bill Miller and hedge fund manager Mark Yusko, have been strongly bullish.

- We know that human behavior is relatively predictable. We seem to be in the middle of a mania, much like the race for technology stocks in the 1990s. The history books have documented manias since the Dutch Tulip mania of 1636. All manias in history have resulted in some form of a crash.

- The underlying concept of the blockchain deserves a lot of attention. It’s possible that blockchain will fundamentally change the way business is conducted.

- Investing in Bitcoin carries serious risks. Nearly anyone can create a cryptocurrency; more than 1,000 already exist. Additionally, Bitcoin currently resides outside the current regulatory regimes. Government intervention could change the prospects for the price of Bitcoin. Bitcoin is nearly impossible to fairly value. It is backed by nothing, it has no earnings, it pays no interest, and we have no history to use in valuing the asset.

- Any investment in Bitcoin should be considered highly speculative. The value could go to zero or the price could soar. Beware of the “Fear of Missing Out” (FOMO). We are all wired with a strong sense of FOMO. FOMO grows stronger as the price of an asset surges.

- We will continue to focus on preserving and growing our clients’ wealth, and, for now, will observe Bitcoin from the sidelines.

The information published herein is provided for informational purposes only, and does not constitute an offer, solicitation or recommendation to sell or an offer to buy securities, investment products or investment advisory services. All information, views, opinions and estimates are subject to change or correction without notice. Nothing contained herein constitutes financial, legal, tax, or other advice. The appropriateness of an investment or strategy will depend on an investor’s circumstances and objectives. These opinions may not fit to your financial status, risk and return preferences. Investment recommendations may change and readers are urged to check with their investment advisors before making any investment decisions. Information provided is based on public information, by sources believed to be reliable but we cannot attest to its accuracy. Estimates of future performance are based on assumptions that may not be realized. Past performance is not necessarily indicative of future returns. The following indexes were used as proxies in the performance tables: Global Stocks = MSCI ACWI; U.S. Large Cap = S&P 500; U.S. Large Value = Russell 1000 Value; U.S. Large Growth = Russell 1000 Growth; U.S. Small Cap = Russell 2000; Int’l Dev Stocks = MSCI EAFE; Emerging Markets = MSCI EM; U.S. Inv Grade Bonds = Barclays U.S. Aggregate; U.S. High Yield Bonds = Barclays Corporate High Yield; Emerging Markets Debt = JPMorgan EMBI Global Diversified; Int’l Bonds = Barclays Global Treasury ex US; Cash = 3month T-Bill; Sector returns displayed in the chart represent S&P 500 sectors, while treasury benchmarks are from Barclays

Quote of the Month

“Remember that history always repeats itself. Every great bubble in history has broken. There are no exceptions.”