Market Perspectives January 2021

Capital Markets

By: Wade Austin

2020 will be a year we wish we could forget but never will. As we transition from the “Year of the Pandemic” to the “Year of the Vaccine,” we are fully aware the humanitarian crisis remains, and the economic scarring from the short-lived recession is more severe for many. Yet remarkably, markets overcame these super-disruptor events and a record setting sell off in March to post a stellar year. Fueled in December by the FDA’s approval of two new vaccines and the passage of an additional $900B stimulus package, U.S. stocks continued to ride November’s post-election momentum and concluded a wild and tumultuous year at all-time highs for the DJIA, S&P 500 and NASDAQ 100 indexes.

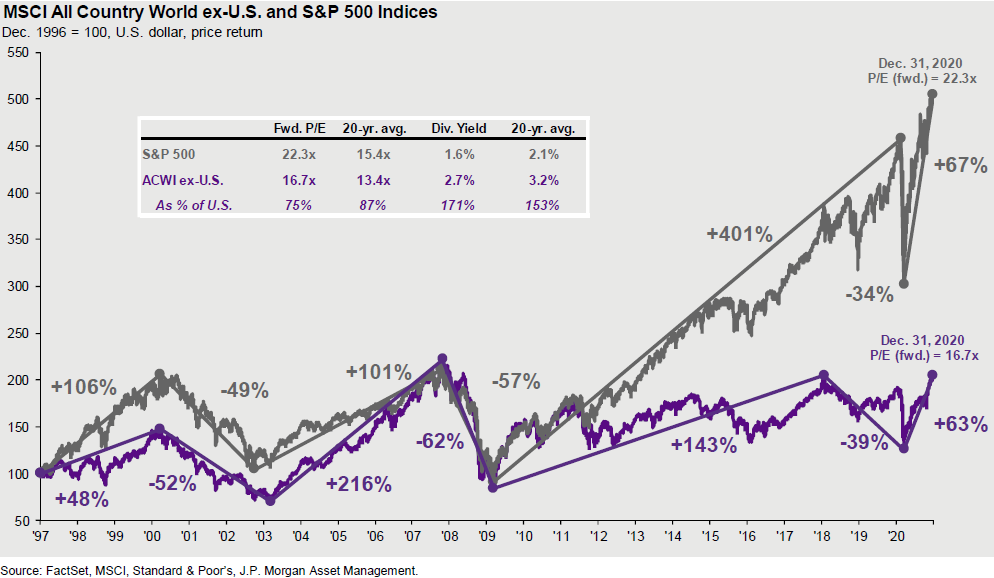

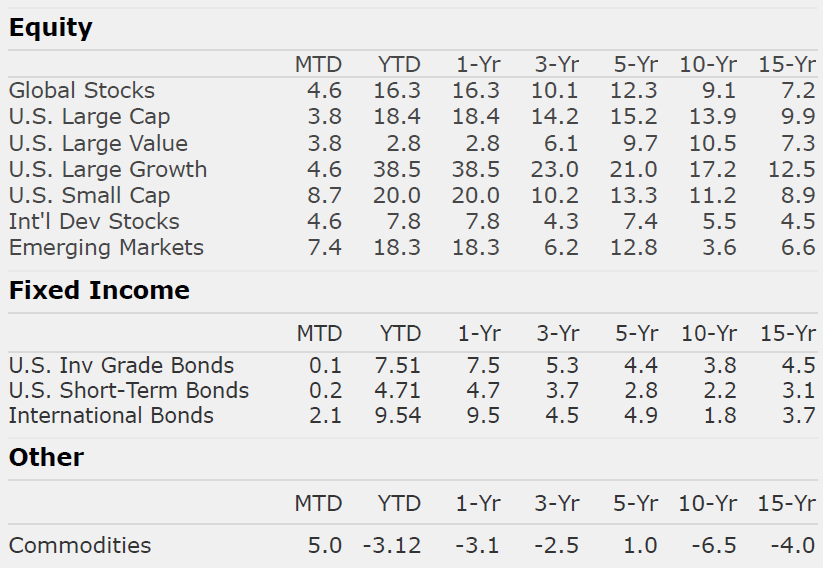

After the -34% meltdown bottomed March 23rd, the S&P 500 rallied 68% to post a full year total return of 18.4%. Despite significant intra-year volatility (a stomach-churning spring 2020), the S&P 500 has been very consistent on a yearly basis. It reached an all-time high for the 11th consecutive year and has finished up 16 of the past 18 years, with down years in 2008 (-37%) and 2018 (-5%).

2020 also marked a record outperformance between large cap U.S. growth (+38.5%) and value (2.8%) as innovative technology companies gained substantial traction during stay-at-home and work-from-home mandates. However, the trends reversed the past three months, as value outperformed growth, small beat large, and non-U.S. beat U.S. during the 4th quarter. Small caps (20.0%) and EM (18.7%) stocks’ full year performance surpassed large cap U.S.

The U.S 10-Yr Treasury note closed the year at 0.92% – less than half its starting point of 1.92%. As a result, fixed income continued to provide portfolios with useful ballast, especially when needed most last spring. Many investors began 2020 owning shorter duration bonds expecting yields to rise. However, the intermediate duration U.S. aggregate bond index generated a full-year total return of 7.5%. Our active core bond managers navigated the volatility even better.

The stock market enters 2021 with exceptional breadth -90% of the S&P 500 in an uptrend, record setting momentum for small caps, and both International and EM stocks surging towards their 2007 highs. With Democrats taking control of the Senate after winning both Georgia seats, stocks are rallying further on the expectations of additional stimulus ($2,000 checks) as soon as February and a larger, structural spending package as early as the summer.

Seemingly overbought conditions and extreme investor sentiment are quickly emerging as potential short term risks. Further, the post-election surge may have pulled forward some of 2021’s return.

The consensus view for 2021 remains pro risk, believing the economic recovery will accelerate to a global expansion phase once vaccines are widely deployed. International stocks have fared well in past cyclical recoveries. If the U.S. dollar continues to weaken, non-US stocks in select regions and sectors may outperform.

However, it is important to be mindful that the consensus was also optimistic last January with no idea of the crisis that lay just ahead. For investors, 2020 was a reminder that, by expecting surprises, we will be better prepared to play the cards dealt prudently and to our advantage. We expect equity markets to be more challenging over the next nine months than the past nine, but long-term investors should note that historically strong market breadth is typically associated with ongoing bull markets.

Insights by John Silvia, Director of Economics

Since the second quarter of 2020, we have emphasized a positive outlook for the economy based upon a reading of leading economic indicators such as jobless claims, factory orders/shipments, building permits and consumer sentiment. As a result, that outlook led us to favor a case for better economic growth and lower inflation and thereby higher financial and housing assets prices than the consensus.

- Despite the reoccurrence of mandated shutdowns that have weakened the economic outlook for the current quarter, the outlook for 2021 remains positive for the factors that we cited last month.

-

- The outlook for 2021 is for stronger global growth – especially for Asia as witnessed from the China trade and PMI surveys.

- Two vaccines have now been approved and are being given to individuals and many more vaccinations will be completed by mid-2021.

- New, more modest stimulus program did get passed in late December.

- The largest component of the economy, the consumer engine, continues to be supported by gains in jobs and incomes. Yes, these gains have been more modest with the recent second set of shutdowns, but looking forward, re-opening the economy will lead to job and income gains. In addition, household wealth remains at an all-time high in the latest quarter as equity values and home prices continue to rise.

- Each recession/recovery presents structural challenges to certain segments of the economy such as hotels and retail/office real estate. Even here, however, recent prices have attracted long-term investors who anticipate a turnaround in communities with favorable demographic/job trends. This has not changed.

- Clients have been rewarded by following the fundamentals and taking a longer view of their position. Recessions are part of the economic cycle, but recovery and expansion are longer lasting. This has not changed.

On the cautious side, there is the public debt issue as the reality of declining potential growth estimates, and a rising deficit to GDP estimate by the Congressional Budget office will force some hard choices going forward. Unfortunately, this has not changed.

Quote of the Month

“The essence of investment management is the management of risks, not the management of returns.”

Benjamin Graham – Influential Investor, Economist, Professor and Author

The information published herein is provided for informational purposes only, and does not constitute an offer, solicitation or recommendation to sell or an offer to buy securities, investment products or investment advisory services. All information, views, opinions and estimates are subject to change or correction without notice. Nothing contained herein constitutes financial, legal, tax, or other advice. The appropriateness of an investment or strategy will depend on an investor’s circumstances and objectives. These opinions may not fit to your financial status, risk and return preferences. Investment recommendations may change, and readers are urged to check with their investment advisors before making any investment decisions. Information provided is based on public information, by sources believed to be reliable but we cannot attest to its accuracy. Estimates of future performance are based on assumptions that may not be realized. Past performance is not necessarily indicative of future returns. The following indexes were used as proxies in the performance tables: Global Stocks = MSCI ACWI; U.S. Large Cap = S&P 500; U.S. Large Value = Russell 1000 Value; U.S. Large Growth = Russell 1000 Growth; U.S. Small Cap = Russell 2000; Int’l Dev Stocks = MSCI EAFE; Emerging Markets = MSCI EM; U.S. Inv Grade Bonds = Barclays U.S. Aggregate; U.S. High Yield Bonds = Barclays Corporate High Yield; Emerging Markets Debt = JPMorgan EMBI Global Diversified; Int’l Bonds = Barclays Global Treasury ex US; Cash = 3month T-Bill; Sector returns displayed in the chart represent S&P 500 sectors, while treasury benchmarks are from Barclays

Sources: Strategas