Investing in Uncertain Times

Celebrating 15 Years!

August 17, 2016

NextGen: A Legacy

April 19, 2017

By: Dustin Barr, CFA

“If you were to distill the secret of sound investment into three words, we venture the motto, MARGIN OF SAFETY.” – Benjamin Graham

Uncertainty

With terrorist attacks, Brexit, political revolt, the possible breakup of the European Union (EU), negative interest rates, stock market volatility, China’s economy in turmoil, and collapsed energy markets all dominating headlines these days, it can be very daunting to put money to work in the stock or bond market. Clients often ask whether the time is right to invest given all of the uncertainty we are seeing lately. Here is my best attempt to answer the question:

- I can’t recall a time that wasn’t uncertain. Looking back on the last seven years, it now seems obvious that we should have bought in 2009 and never looked back. But in 2011, I recall many sophisticated investors who feared an impending double dip recession and an S&P 500 retreat back to its March 2009 lows. Instead the S&P 500 has nearly doubled since then.

- Heightened uncertainty often provides good opportunities to invest. The U.S. debt downgrade of 2011 created a tremendous amount of uncertainty and gave investors a chance to buy at lower prices, only to realize significant gains over the last five years.

- The alternative to investing is to hold cash. Historically, hoarding your money in cash has led to inferior performance, and in today’s environment you literally receive a zero return.

Staying Invested is Far More Important than Timing

Thankfully, being invested is far more important than timing when to invest. Going back to 1950, an investor who evenly split their allocation between the broad U.S. stock and bond indexes has never lost money if held for at least 5 years.

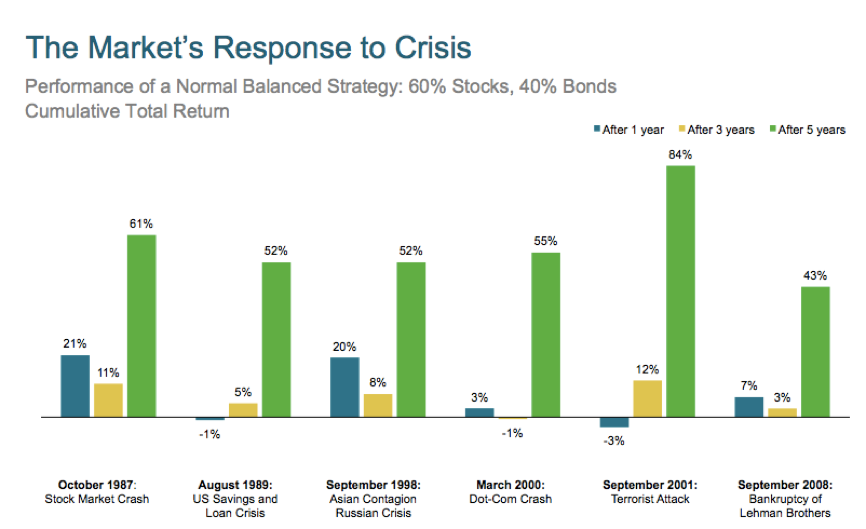

In the long-run, markets have a way of compensating investors for taking risk. Even in cases when investors bought at the wrong time, those who held on through the bad times are typically rewarded with a reasonable return. The next chart highlights a 60/40 portfolio’s return if purchased when various crises erupted. Starting with the 1987 stock market crash, investors holding firm over the following 5-year period earned cumulative returns between 43% and 84% despite experiencing painful drops in their asset values along the way.

Source: Dimensional Fund Advisors and Michael Batnick, Ritzholz Wealth Management.

Margin of Safety

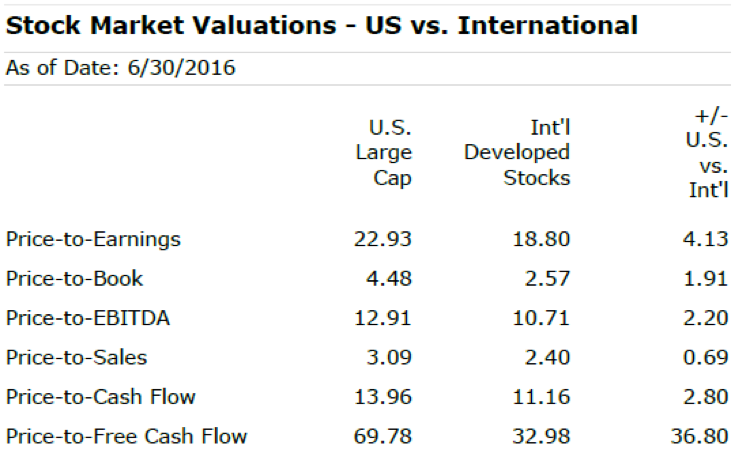

Benjamin Graham, the “Grandfather of Value Investing” and Warren Buffett’s mentor, coined the term “Margin of Safety”, positing that buying companies for less than they are really worth limits risk of permanent loss. In extremely uncertain times there are always places to find margins of safety. Some have argued that both bonds and stocks are expensive these days, and thus there is no margin of safety. While true that both U.S. stocks and bonds may look less attractive than in March 2009, there are market segments that appear to offer attractive relative value. In looking across the globe, international stocks appear to provide a greater margin of safety than U.S. stocks do these days. The chart below highlights the valuations of U.S. Stocks vs. International Developed Stocks (Europe, Japan, Canada, Australia, etc.).

Source: Morningstar Direct.

The stock market has put international stocks on sale over the last few years, while U.S. stocks have continued to charge retail prices – a result of strong returns from the latter. While U.S. stocks may continue to outperform their international brethren in the months to come as the current market momentum favors U.S., attempting to time the leadership change is nearly impossible. Today’s market valuations suggest that the expected return for international stocks are higher than U.S. stocks over a 5-year or longer time frame. Over the long-haul, investors are typically rewarded for buying stocks at attractive valuations and in today’s environment certain segments of the markets offer investors a greater margin of safety than others.

Stay Diversified

After years of the U.S. stock and bond market delivering strong results, it might be tempting to sit in cash and wait for a big market drop, or to even sell laggards such as international equites, emerging markets equities and commodities in favor of more U.S. stocks. History suggests that each of these strategies will leave you with less money than sticking with a well-diversified, rules based plan. Successful long-term investors construct enduring portfolios that stand the test of time and stay invested during the most painful and profitable times alike. And when tempted to bail out of the worst performing asset classes, remember Graham’s “Margin of Safety” principle for rebalancing towards the out of favor asset classes and away from the hot asset class. These prudent steps in alignment with your strategic objectives should ultimately lead to happy outcomes.

Dustin Barr, CFA is a Consultant & Director of Research at Carolinas Investment Consulting. He oversees the CIC Investment Committee and manager research and due diligence process at the firm. He provides investment & financial advice to families, non-profits, and corporate retirement plans. Click here to learn more about Dustin and how he can help you.

The views and opinions expressed in this article are those of the author and do not necessarily reflect the official policy or position of Carolinas Investment Consulting. All data sourced from Morningstar Direct unless otherwise noted. The information published herein is provided for informational purposes only, and does not constitute an offer, solicitation or recommendation to sell or an offer to buy securities, investment products or investment advisory services. All information, views, opinions and estimates are subject to change or correction without notice. Nothing contained herein constitutes financial, legal, tax, or other advice. The appropriateness of an investment or strategy will depend on an investor’s circumstances and objectives. These opinions may not fit to your financial status, risk and return preferences. Investment recommendations may change and readers are urged to check with their investment advisors before making any investment decisions. Information provided is based on public information, by sources believed to be reliable but we cannot attest to its accuracy. Estimates of future performance are based on assumptions that may not be realized. Past performance is not necessarily indicative of future returns. The following indexes were used as proxies in the performance tables: Global Stocks = MSCI ACWI; U.S. Large Cap = S&P 500; U.S. Large Value = Russell 1000 Value; U.S. Large Growth = Russell 1000 Growth; U.S. Small Cap = Russell 2000; Int’l Dev Stocks = MSCI EAFE; Emerging Markets = MSCI EM; U.S. Inv Grade Bonds = Barclays U.S. Aggregate; U.S. High Yield Bonds = Barclays Corporate High Yield; Emerging Markets Debt = JPMorgan EMBI Global Diversified; Int’l Bonds = Barclays Global Treasury ex US; Cash = 3month T-Bill; Sector returns displayed in the chart represent S&P 500 sectors, while treasury benchmarks are from Barclays.