Climbing the Latest Wall of Worry

Leaving Your Job? Don’t Forget Your Money!

September 30, 2019

Ten: A Deceptively Convenient Round Number

December 18, 2019

By: Wade Austin

Yikes! The U.S.-China trade war, negative interest rates, twin yield curve inversions, Brexit confusion, a global economic slowdown, U.S. recession fears, the impeachment inquiry, geopolitical conflicts, and upcoming 2020 elections form an abundance of worrisome concerns confronting investors. All are a cause for uncertainty.

For many investors, the resulting tension is heightened given the scars from last decade’s Great Recession and two S&P 500 drawdowns of 50%. No wonder anxiety levels are high!

Yet here we stand near all-time highs in the U.S. stock market and amidst both the longest U.S. bull market and economic expansion on record. How that can be?

There are obviously myriad factors, but a popular rationale is we’ve been climbing the proverbial ‘Wall of Worry’. This phenomenon describes financial markets’ periodic tendency to continue rising during a cycle despite a collection of negative circumstances and factors. Prices increase because a majority of investors believe the issues are either overstated or will ultimately get resolved at some point.

Legendary investor Sir John Templeton profoundly observed, “bull markets are born on pessimism, grow on skepticism, mature on optimism, and die on exuberance”. In the current cycle, the foundation for the latest ‘Wall of Worry’ was poured in March of 2009, when the bull market began more from an exhaustion of panicked sellers than excited buyers.

And during this lengthy bull market, investor sentiment hasn’t reached exuberance levels. Despite historically low interest rates, investors are still largely cautious with outsized positions in bonds and cash (currently $3.5 Trillion in money market funds1). Domestic equity funds have experienced net outflows four of the past five years, during which the S&P 500 surged a 62.8% total return.

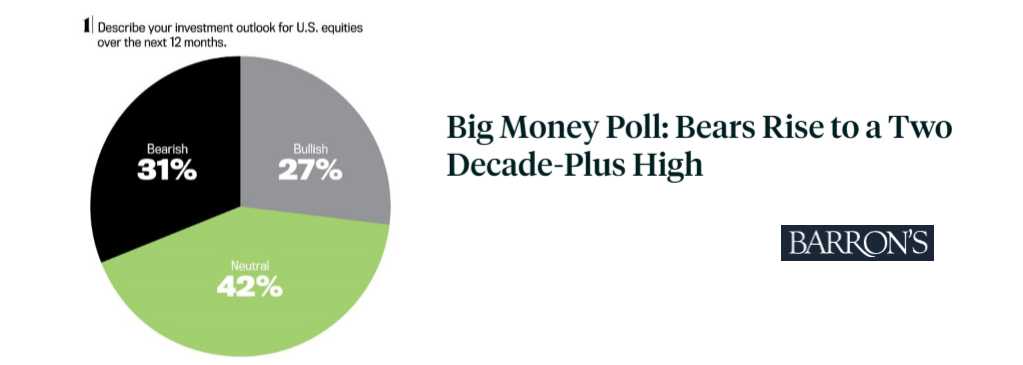

Barron’s recent “Big Money Poll” indicated the percent of bearish investors is at a two-decade high.

Source: Barron’s 10/26/2019

Investor confidence and sentiment surveys are closely monitored indicators of investors’ risk appetite. However, actions speak louder than words.

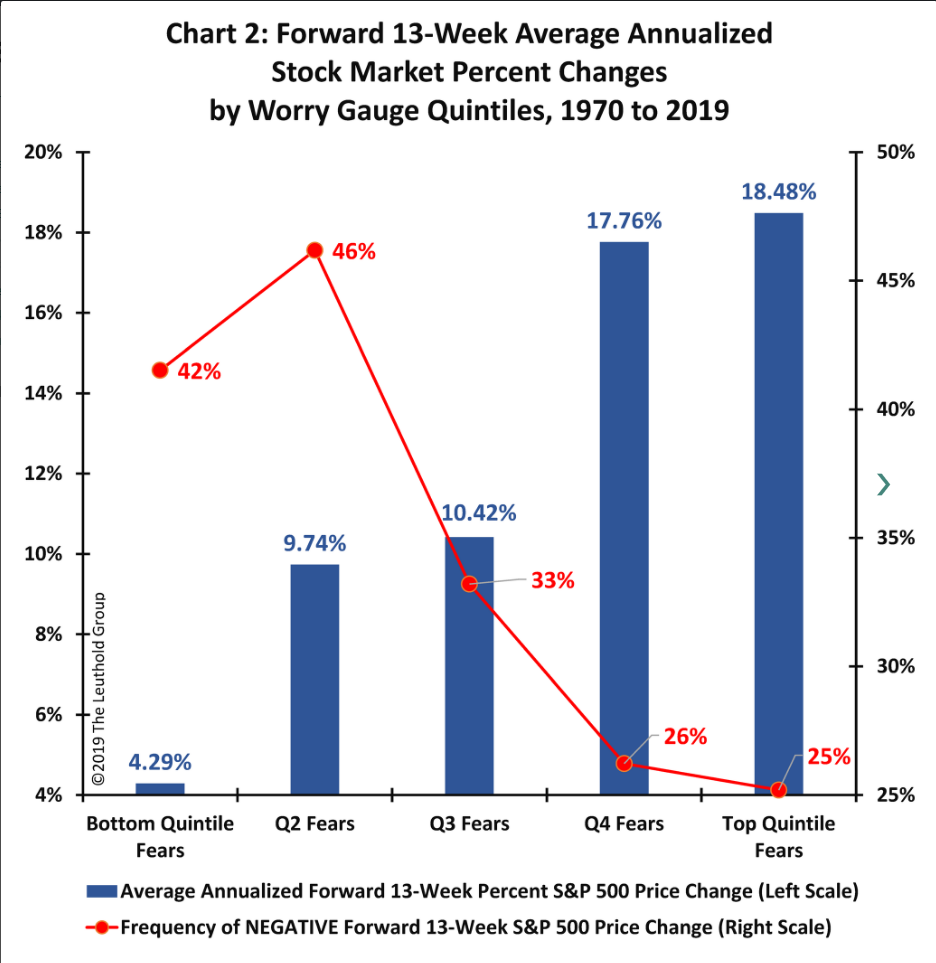

So The Leuthold Group constructed a ‘Worry Gauge’ to track actual investor behavior. Their ratio divides the price of gold relative to commodities (as a proxy for fear-based investor behavior) by the price of U.S. small cap stocks relative to large caps (as the investor confidence barometer). This ‘Worry Gauge’ revealed that peak measures of investor fear occurred February 1999 (a great year for markets) and February 2009 (the beginning of this record long bull market). Conversely, investor confidence was at a top quintile high in 2006 and 2007 (just before the Great Recession).

More recently, Leuthold’s Worry Gauge has registered nearly continuous top quintile fear for the past four and one-half years of the current bull market. The only occasion when the Worry Gauge dropped below the top quintile was in September 2018. You guessed it; just before last trimester’s 19% correction.

Leuthold then charted the S&P 500 forward average annualized 13-week percentage price change for each Worry Gauge quintile since 1970. The periods of peak investor enthusiasm, and conversely worry, have proven to be positive contrarian signals for market returns and risk profiles.

Source: The Leuthold Group – Paulsen’s Perspective, 4/22/2019

Bottom quintile fears (i.e. when investors behavior was most bullish) generated average returns of 4.29% annualized and future stock market declines occurred 42% of the time. Conversely, when investors were most cautious and fearful (the top two quintiles), annualized returns were a stellar 17.7% and 18.4% with much lower market declines frequencies.

Clearly the stock market landscape is influenced by a complex set of factors. Investor worry and confidence are just one, but a notable indicator.

Recently, recession fears have been a primary component of the Wall of Worry. John Silvia, CIC’s Director of Economics and formerly Wells Fargo’s Chief Economist, places the current odds of a recession in the next 6 – 9 months at only 15%.

My model places the current odds of a recession in the next 6 – 9 months at only 15%.

Strategas, a leading macro institutional research firm, released their ‘Bull Market Top’ Checklist1 as of 9/30/19 comprising nine factors, all of which were present in 2000 and 2007, just prior to the last two recessions. The factors ranged from blow-off top valuations to widening credit spreads. Strategas’ assessment was that none of those nine conditions exist today!

While some worries are justified, they also attract prescriptive measures in the form of monetary and fiscal policies, both home and abroad, designed to support stocks and economic growth. The Fed abruptly reversed course in January with the first of now three rate cuts spiking this year’s rally. No one anticipated January’s cut. But worried investors who pulled out locking in December’s decline, also have likely missed October 31st YTD returns of 23%.

Staying appropriately cautious is prudent and warranted, but a bull market is rarely a peaceful place. The coast is comfortably clear only in hindsight. But if short-term market clarity is elusive, trust in the achievement of your longer-term financial goals can be well-grounded.

We find that understanding the risk profile of your portfolio (carefully customized to your specific needs, goals, resources, risk tolerance, and time horizon) helps avoid emotional decisions that often lead to regrettable mistakes. Managing your portfolio with patience and discipline best enables you to scale that Wall of Worry with confidence and peace of mind.

1 Source: Strategas Quarterly Review in Charts, 10/1/19

Wade Austin is an Investment Consultant at Carolinas Investment Consulting. He provides investment & financial advice to families, executives, institutions, and non-profits. Click here to learn more about Wade and how he can help you.

The views and opinions expressed in this article are those of the author and do not necessarily reflect the official policy or position of Carolinas Investment Consulting. All data sourced from Morningstar Direct unless otherwise noted. The information published herein is provided for informational purposes only, and does not constitute an offer, solicitation or recommendation to sell or an offer to buy securities, investment products or investment advisory services. All information, views, opinions and estimates are subject to change or correction without notice. Nothing contained herein constitutes financial, legal, tax, or other advice. The appropriateness of an investment or strategy will depend on an investor’s circumstances and objectives. These opinions may not fit to your financial status, risk and return preferences. Investment recommendations may change and readers are urged to check with their investment advisors before making any investment decisions. Information provided is based on public information, by sources believed to be reliable but we cannot attest to its accuracy. Estimates of future performance are based on assumptions that may not be realized. Past performance is not necessarily indicative of future returns.