You Missed the Cut, Now What?

Market Perspectives – April 2019

April 10, 2019

What do Horse Racing and Investing have in Common? There’s No Sure Bet!

June 4, 2019

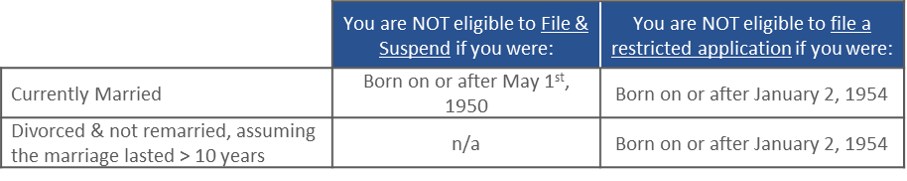

Back in 2015, new social security rules were signed into law that closed two very lucrative loopholes for a majority of Americans – (1) File & Suspend and (2) the Restricted Application. The new law tied eligibility to birth dates, restricting the use of both strategies exclusively to older individuals. The actual cut-off dates are below:

As you can see, if you were born on or after January 2nd, 1954, you are not able to file & suspend nor are you eligible to file a restricted application. However, if you are married, or divorced after being married for more than ten years, there are still strategies to consider when applying for retirement benefits.

As an individual, you are eligible for social security retirement benefits once you accumulate 40 “social security credits.” You can earn up to four credits each year, one credit per $1,360 (2019) of earned income. The amount of earned income you need per credit changes each year to adjust for inflation. To receive all four credits for 2019, you would have to earn at least $5,440. After ten years with income over the cap, you will have accumulated all 40 credits, achieving eligibility for social security retirement benefits.

When you apply for benefits, assuming you have earned all 40 credits, the social security administration will pull your earnings record and average your 35 highest-earning years, indexed for inflation. (If you have not worked a full 35 years, zeros will be used to calculate the average). They will then use that average to determine your Primary Insurance Amount (PIA), the amount you will receive if you choose to begin benefits at your Full Retirement Age (FRA).

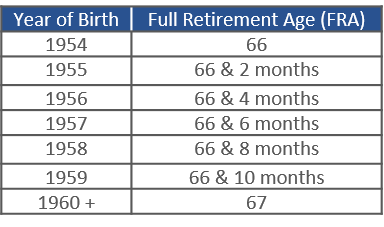

You can apply for retirement benefits as early as age 62 and as late as age 70. However, if you begin benefits before your FRA, the benefit you receive will be permanently reduced based on the number of months before your FRA you received benefits. The opposite is true about delaying benefits. For each year you delay benefits past your FRA, your benefit will be permanently increased by 8% up until you turn 70. For example, if you reach your FRA at age 66 but you delay benefits until age 70, you will receive 132% of your FRA benefit when you file. Your Full Retirement Age is based on your year of birth as shown in the table below.

If you are unmarried, and have never been married, you will apply for benefits based on your own earnings record (your “Retirement Benefit”). You can delay your benefit to take advantage of the 8% per year growth, but there is not much strategy to consider past that.

However, if you are currently married, or are divorced after having been married for over 10 years, you may be eligible to receive benefits based on your spouse’s or ex-spouse’s earnings record (your “Spousal Benefit”). If you apply for benefits based on your spouse’s record at your FRA, you should receive 50% of the benefit your spouse would be eligible to receive at his/her FRA, no matter the age your spouse begins his/her benefits. For example, if you are eligible to receive $1,000 based on your earnings record at your FRA and your spouse is eligible to receive $3,000 based on his/her record at his/her FRA, when you reach your FRA, you can apply for spousal benefits of $1,500, 50% of the $3,000 your spouse is eligible to receive at his/her FRA.

There is a caveat, though; in order to apply for Spousal Benefits, your spouse must already be receiving their Retirement Benefit. If you apply for your benefit before your spouse begins his/her own benefit, you will receive a benefit based on your own record. If, at the time your spouse applies for his/her own benefit, the benefit you could be receiving based on your spouse’s record (50% of his/her FRA amount) is greater than the amount you are currently receiving, you will automatically be bumped up to the higher amount. If you began taking your benefit early and later switch to your spousal benefit, both your own benefit and your spousal benefit will be reduced because you started your benefit before your FRA.

After being stepped up to your spousal benefit, aside from annual cost of living increases, your benefit will most likely stay constant until your spouse passes away. At that time, if the benefit they were receiving is greater than the benefit you are currently receiving, you will start receiving the amount they used to receive. In other words, your benefit amount would be replaced by their benefit amount, if greater.

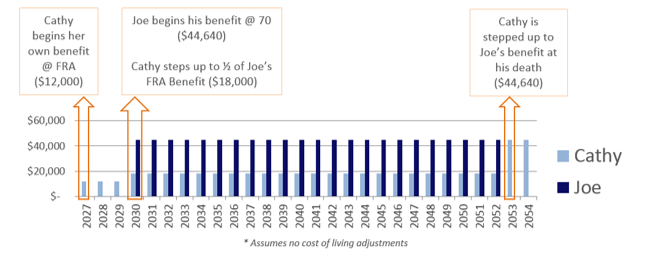

When we run social security analyses for our clients who are too young to file & suspend or file a restricted application, the results typically favor the husband delaying his benefit until age 70 and the wife beginning benefits at her FRA. This recommendation most frequently comes into play in instances when the husband made substantially more money over the marriage.

For example, Joe and Cathy (both born in 1960) reach FRA when they turn 67 in 2027. Based on Cathy’s earnings record, she is eligible to receive $12,000 in retirement benefits if she files at her FRA. Joe is eligible to receive $36,000 if he files at his FRA. When Cathy turns 67, she files on her own earnings record and begins receiving $12,000 per year. Joe decides to wait until he turns 70, at which point his benefit has grown by 24% (8% for each of the 3 years he delayed after his FRA) to $44,640. When Joe files, he will receive $44,640 per year and Cathy will automatically be stepped up to her spousal benefit of $18,000, 50% of Joe’s FRA benefit, not the benefit Joe receives at age 70. When Joe passes away, Cathy will again automatically be stepped up, this time to $44,640, the benefit Joe was receiving at his death. The visual below shows this scenario:

That said, everyone’s situation is different. There are many factors that play into a social security benefit claiming strategy. I urge you to talk through your options with the social security administration or a financial planner before making an election. In our office, we run a social security optimization analysis to help our clients pick the strategy that works best with their overall financial plan. You’ve been paying into the system for years; take the time to ensure you don’t leave your hard-earned money on the table.

Bridget McDermott, CFP® is a financial planner in Charlotte, NC. Click here to learn more about Bridget.

Nothing contained herein constitutes financial, legal, tax, or other advice. The views and opinions expressed in this article are those of the author and do not necessarily reflect the official policy or position of Carolinas Investment Consulting. The information published herein is provided for informational purposes only, and does not constitute an offer, solicitation or recommendation to sell or an offer to buy securities, investment products or investment advisory services. All information, views, opinions and estimates are subject to change or correction without notice. The appropriateness of an investment or strategy will depend on an investor’s circumstances and objectives. These opinions may not fit to your financial status, risk and return preferences. Past performance is not indicative of future returns.